India Smartphone Market Reached 37million Shipments – A Second Quarter Record

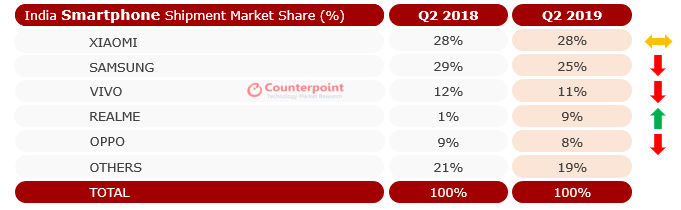

- Top 5 smartphone brands contribution reached the highest ever level in Q2 2019.

- Realme, Asus, OnePlus and Nokia HMD were the fastest growing brands year on year.

- OnePlus shipments reached an all-time high during Q2 2019 making a place in the top ten list for the first time.

The smartphone shipments in India grew to 37 million units, single-digit annually during Q2 2019 setting a second-quarter shipment record, according to the latest research from Counterpoint’s Market Monitor service. The growth was driven by new launches, price cuts on older devices and channel expansion across brands.

Commenting on the market strategy, Tarun Pathak, Associate Director, said, “Brands which focused on offline channels expanded to online channels with online-exclusive series. Similarly, brands which entered the market with online-exclusive series are now expanding their reach towards offline channel by forming partnerships with key offline retailers. This strategy is working well for all the leading at-scale players. Also, brands are launching multiple series to target or expand into new product tiers. This is helping them to expand their product portfolio to target multiple fast-growing segments and also diversify.

“In India, the pricing sweet-spot for consumers has moved to INR 10,000-20,000 price band and it will remain the biggest contributor in the India smartphone segment this year. Brands are focusing on bringing the latest premium level specifications such as notch display, full-screen view, multiple rear cameras, pop up selfie feature and in-display sensor technology in this segment to stimulate consumer demand”, he added.

Commenting on the overall smartphone market, Anshika Jain, Research Analyst at Counterpoint Research said, “The top five brands’ contribution to the total shipments volume reached its highest ever level driven by new launches and hybrid channel strategy. Localization, branding, and innovation will remain to be the next key drivers for growth in a highly competitive market like India. The market will continue to become more concentrated with majority of share controlled by a few brands leading to more number of exits among the long-tail brands in the market moving forward.”

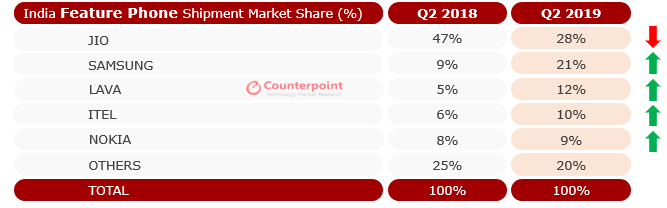

Exhibit 2: India Feature Phone Market Share Q2 2019

Source: Counterpoint Research Market Monitor Q2 2019

While the smartphone market registered growth YoY, the feature phone market witnessed a steep decline of approx 39% annually coming from a very strong demand for Reliance Jio’s Jiophone a year ago and some inventory built-up in the market for Jio. The feature phone demand is back to the 2017 (pre-Jiophone) level but it remains to be seen if the entry-level smartphones in coming quarters are able to attract the hundreds of millions of feature phone users. Due to the slowing demand for Jiophone players such as Samsung, Lava and iTel were able to capture share in sub-INR 1000 segment during the quarter.

Exhibit 2: India Feature Phone Market Share Q2 2019